Ad hoc announcement pursuant to Art. 53 LR

February 27, 2025Strong performance and continuously improved profitability

2024 HIGHLIGHTS

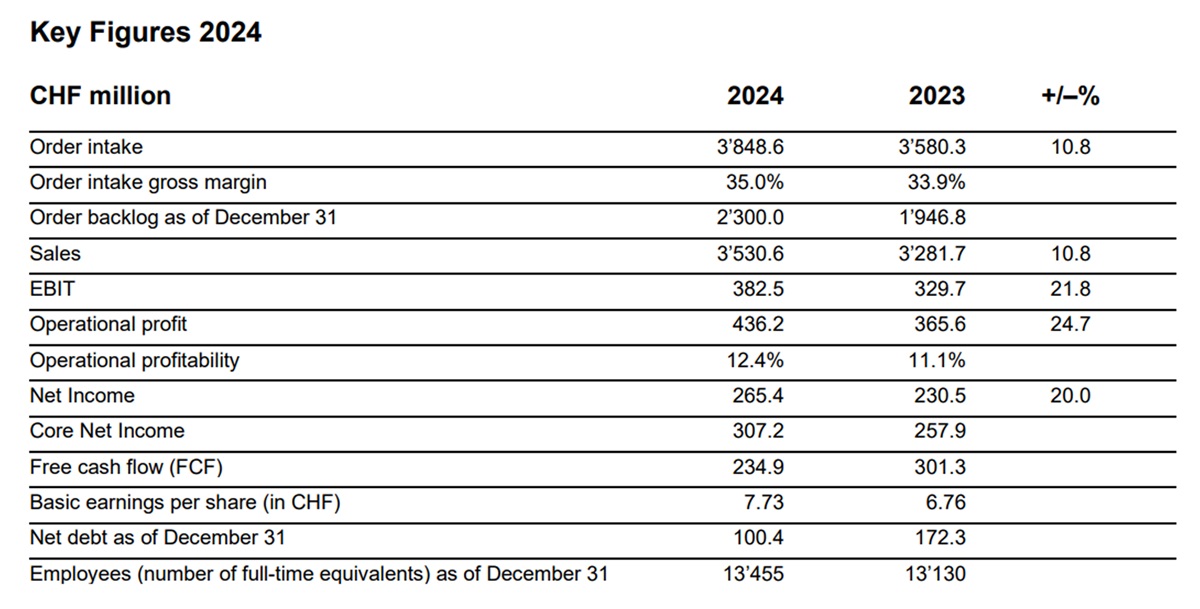

- Sales at CHF 3’531m, +10.8%, on market share gains and good market momentum

- Operational profit at CHF 436m, +24.7%, on growth and cost management

- Operational profitability of 12.4%, +130 bps, reflecting strategy implementation

- Free cash flow at CHF 235m, -22.1% (nominal), due to growth and excellence investments, and higher backlog execution

Note: If not otherwise indicated, changes in % compared to the previous year are based on organic figures (adjusted for currency effects, acquisitions/divestitures and deconsolidations).

Divisional performance

Flow achieved an operational profit of CHF 137.4 million, up 31.4% compared to 2023. Order intake amounted to CHF 1’603.3 million, up 12.3%, while sales amounted to CHF 1’444.3 million, up 9.4%.

Services achieved an operational profit of CHF 186.7 million, up 15.1% compared to last year. Order intake increased by 12.5% to CHF 1’378.3 million, while overall sales also grew double-digit by 12.3% to CHF 1’249.1 million.

Chemtech achieved an operational profit of CHF 118.0 million, up 29.0% compared to 2023. Order intake amounted to CHF 866.9 million, up 5.4%, while sales amounted to CHF 837.1 million, up 10.9%.

Creating value

“The results are an expression of our joint efforts in doing what we do best: ensuring that our customers can produce more and at better quality. All three of our divisions have contributed to the continuous growth,” said Executive Chairwoman Suzanne Thoma. The implementation of the company strategy “Sulzer 2028” continued in 2024. First results of the ongoing initiatives show that by reducing complexities, redesigning processes and fostering a culture of continuous improvement, Sulzer can create meaningful value – not only for shareholders, but for customers and employees alike.

Outlook: resiliently positioned

As for 2025, Sulzer is focused on the path to become a top industrial company that truly creates value. Sulzer will continue to invest in key areas across the company and execute on the excellence and growth initiatives. Due to the limited visibility of the market developments and the unpredictable timing of expected large orders, the year-on-year growth of order intake is difficult to forecast, especially on a quarterly basis. However, Sulzer is confident in its strategy and position in essential markets. The company expects another year of good performance with year-on-year organic growth for order intake of 2% to 5% and for sales of 5% to 8%. The EBITDA margin is expected to further increase to above 15% of sales.

Proposal of the Board of Directors

A dividend of CHF 4.25 per share will be proposed by the Board of Directors at the Annual General Meeting on April 23, 2025, compared to an ordinary dividend of CHF 3.75 per share in 2024. This reflects Sulzer’s resilient portfolio exposure and ambition of delivering excellence.

Furthermore, the Board of Directors proposes the re-election of all current members of the Board of Directors (including the Board Chair) and the Remuneration Committee.

Annual report and media & IR conference

The documents on the 2024 financial reporting will be available at 6.00 a.m. on February 27, 2025, on our website under: Investor Relations

An online version of the annual report 2024 is available here: Annual Report 2024

The annual media and investors conference will take place on February 27, 2025, at 10:00 a.m. Please use the following link to register: Link

Your spokesperson

Media Relations

Marlène Betschart

Head of Communications

Sulzer Management Ltd

Neuwiesenstrasse 15

Switzerland

Investor Relations

Thomas Zickler

Chief Financial Officer

Sulzer Management Ltd

Neuwiesenstrasse 15

Switzerland